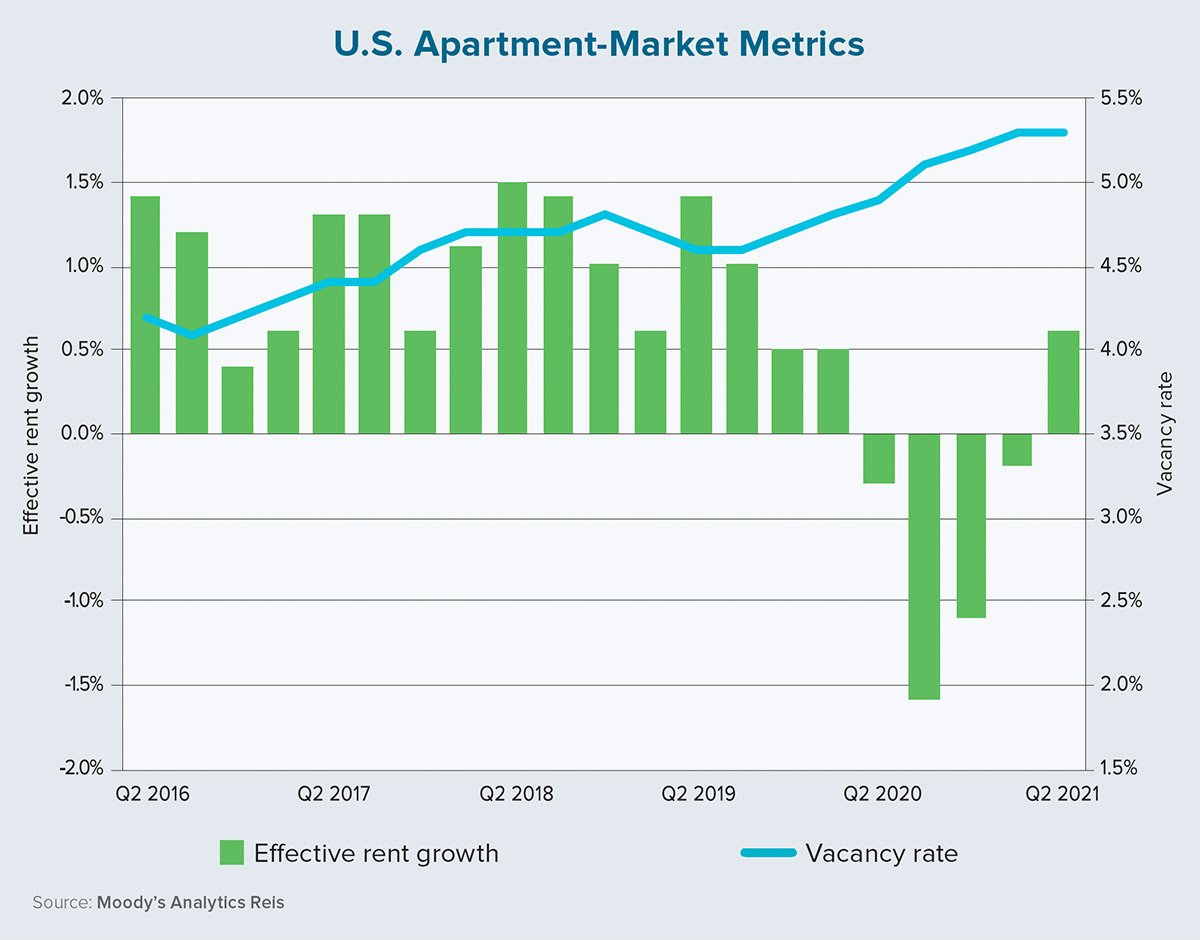

On the back of a resurgent economy and solid employment gains, rents for U.S. multifamily housing are on the rise. The nationwide increase of 60 basis points in second-quarter 2021 marked the first gain in effective rents for more than a year, according to Moody’s Analytics Reis. Given a rosy economic outlook in the near term, we firmly expect this growth to continue and to likely accelerate through the remainder of 2021.

The healthy rebound in rents has diminished concerns of a longer and larger-scale dip in demand for apartments. Absorption in the multifamily sector, which tends to lag slightly behind employment trends, was buoyed by the more than 3 million jobs added to payrolls during the first six months of this year. While the potential for impactful, structural changes in how we live, work and play still remain, worries that large swaths of the population will head for single-family housing are losing steam.

Much has been made about the movement of millennials away from apartments and toward single-family housing. While this shift is occurring, the rapid acceleration in U.S. home prices has — and will continue to — price out many of these potential homebuyers. Layer in a new generation of young, working professionals who are ready to form their own households (while possibly finding slight discounts on rents in urban areas), and prospects for apartment demand look bright in both the short and long term.

On the supply side, relative to absorption, inventory gains have been subdued. Through the first half of this year, U.S. apartment completions totaled about 60,000 units, placing these activities on pace for their slowest year since 2013. The usual lag in the creation of new supply following an economic recession is occurring. Although multifamily developers finished many projects in 2020 (about 200,000 new units came online last year), they also were busy reassessing the prospects of lease-ups and potentially tighter financing for upcoming projects. This uncertainty, combined with rising material costs and labor shortages, has reduced construction activities in 2021.

The dynamics of supply and demand have helped rents to recover at the national level, but how broad is this recovery at more granular levels? The COVID-19 pandemic has severely affected dense and expensive markets such as San Francisco, New York City and Washington, D.C., each of which recorded annualized rent declines in excess of 7% last year. Meanwhile, smaller and less expensive cities — many in emerging, warm-weather areas — had only moderate distress in 2020. Many of these markets had rent declines of less than 1%.

Second-quarter 2021 data points to a broad recovery with some nuance. Although 80 of the 82 primary markets we analyzed had quarterly rent increases, San Francisco and Suburban Virginia (outside Washington, D.C.) had subtle declines while New York City’s rent increase of 0.3% was well below average. At the other end of the spectrum, metros such as Albuquerque, New Mexico; Atlanta; Palm Beach, Florida; and Salt Lake City had quarterly rent-growth increases of 1.2% to 1.6%.

While we remain bullish on the mid- to long-term prospects of large, dense urban centers, these divergent recovery rates are likely to continue in the short term — and potentially longer as remote-work policies continue to evolve. As a prime example, we do not expect San Francisco apartment rents to return to 2019 levels until 2027.

The multifamily sector is now firmly in recovery phase. While the rebound may be somewhat uneven across metro areas, robust economic growth (to the tune of a 6.7% gross domestic product growth forecast by S&P Global) and the potential for a sub-5% unemployment rate by the end of this year will undoubtably lift the rising tide of the apartment sector.

Expect year-end national rent growth to be in the vicinity of 2.5% and for the vacancy rate to hold steady in the range of 5%. Systematic downside risks are minimal, but a reemergence of COVID-19 infections is always a possibility. As for inflation, growth rates for the consumer price index will remain elevated this year as the glut of excess household savings is spent down, but we do not see this as a significant hindrance to multifamily housing. ●

Author

-

Thomas LaSalvia, Ph.D., is senior economist at Moody’s Analytics Reis. He has extensive experience in urban economics and credit risk.

View all posts