Industrial real estate is often examined through the lens of retail spending, consumer demand and consumer sentiment. After all, industrial spaces store and dispatch the products that people buy. Nonetheless, these properties also are used for manufacturing activities, so observed production and producer sentiment also shed light on this commercial property type.

Recent data reveals a shifting tide in the health and perception of U.S. manufacturing, given ongoing macroeconomic developments such as negative quarterly growth in real gross domestic product. Rising interest rates increase the cost of borrowing, so the goods trade is likely to face downward pressure in 2023. There also is the chance of a domino effect as manufacturing, and the subsequent warehousing and distribution needs for these goods, might shrink and thereby lower demand for industrial properties.

Supply chain pressures, although finally easing from their pandemic-era peaks, have caused widespread reassessment throughout the manufacturing industry about where goods should be produced. Reshoring and nearshoring efforts have gained fervor since the onset of the COVID-19 crisis, which means that property subtypes across the industrial sector are likely to benefit due to the increased domestic need for space to house research, production, assembly, storage and distribution facilities.

The Federal Reserve Board measures real production output in the U.S. for manufacturing, mining, utilities and other sectors via its monthly Industrial Production Index. Focusing on the manufacturing-specific index since its most recent trough in April 2020, the index has generally climbed with the occasional dip. The industrial production indices, whether for manufacturing or consumer goods, show that as industrial production accelerates, industrial real estate occupancy rates also increase across the board and higher rents follow.

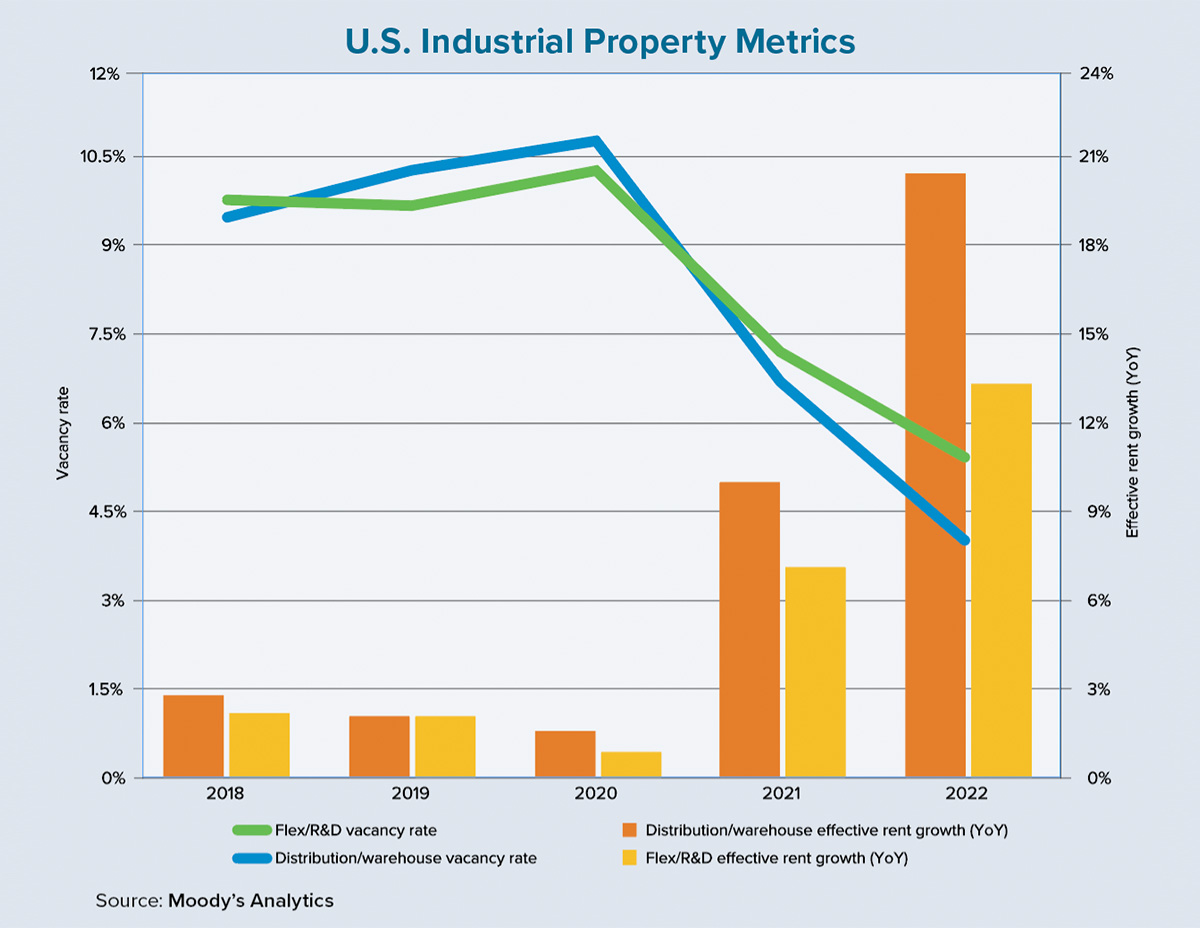

Despite elevated manufacturing and consumer goods production through 2022, the chart on this page shows that space-market data for the industrial sector is reflecting the start of a softening period. This is occurring across distribution and warehouse properties, as well as flex spaces for research and development (R&D) purposes. Many U.S. metros are seeing lower or even negative absorption rates, although last year also featured more completions as developers and investors sought to capitalize on the booming sector.

Therefore, while there is certainly no cause for alarm, it is important to note that the industrial sector is showing early signs of a move away from roaring growth and toward stabilization. The vacancy rate for distribution and warehouse space is one such example: It stabilized at 4% throughout the second half of 2022 as the subsector recalibrated to accommodate an influx of new supply coupled with moderating demand. Industrial properties remain healthy from a capital-markets perspective, as Moody’s Analytics data found that the share of all industrial property loans that are at least 60 days delinquent is at a 14-year low of 0.51% as of November 2022.

Industrial properties as a whole have performed spectacularly well, supported by industrial production numbers for both manufacturing and consumer goods. But another leading indicator, the Institute for Supply Management’s Purchasing Managers Index (PMI), tells a different tale.

Despite an uptick after the initial shock of the pandemic, the PMI has steadily trended lower during the past two years even as manufacturing activity has grown. An index reading above 50 represents expansion within the manufacturing sector compared to the prior month, while a reading below 50 represents contraction.

This past December, the PMI stood at 48.4, which followed a reading of 49 in November. Consequently, while the index was above 50 for the majority of the year, the deceleration in manufacturing mirrors the trend that has emerged for industrial real estate performance metrics. Nonetheless, the tide has not turned toward a widespread contraction in manufacturing — at least, not yet. ●

Author

-

Ermengarde Jabir, Ph.D., is an economist at Moody’s Analytics Reis. She specializes in commercial real estate with particular expertise in real estate investment trusts.

View all posts