Real estate investing is never for the faint of heart. The past few years, however, have been particularly trying ones for commercial mortgage brokers, builders and developers as they’ve been forced to navigate a global pandemic, labor shortages, inflation, supply chain disruptions and skyrocketing interest rates.

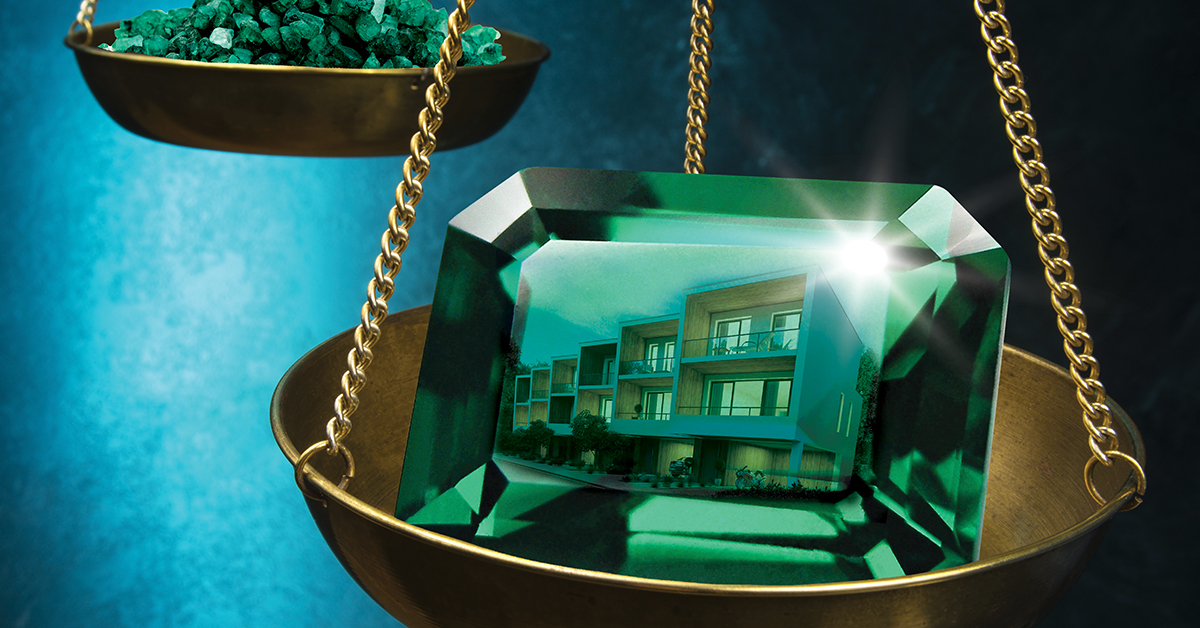

Even through all the recent economic ups and downs, there have been bright spots for commercial real estate — one being multifamily housing. The apartment market remains a hot commodity for those looking to buy into the sector, but brokers need to help their clients know where to invest.

“The bottom line is that smaller households combined with a growing population equates to the need for more housing units.”

Builders and developers entered 2020 scouring for land and trying to assuage a bevy of community and environmental concerns. They were then buffeted by a labor shortage as the residential real estate market took off during the throes of the COVID-19 crisis, due in part to historically low interest rates and a renewed focus in working from home.

On top of such changes came soaring construction costs, with the price of lumber jumping by 182% during a seven-month period starting in October 2020. At the same time, supply chain freezes pushed up the cost of nearly everything else while greatly limiting its availability. Now, partly in an effort to fight these elevated prices, mortgage brokers and their clients are faced with higher interest rates and tighter borrowing standards, both of which will make financing a new project or acquisition more difficult.

Silver lining

Indeed, between October 2021 and October 2022, mortgage rates more than doubled. Meanwhile, the cryptocurrency movement — once one of the hottest asset classes of the pandemic era — was in free fall due in part to the bankruptcy of the cryptocurrency exchange FTX.

At the same time, the stock market failed to complete a late-year rally after the major indexes dropped more than 20% this past summer. This makes commercial real estate (and multifamily housing in particular) look good compared to the risk inherent in other asset classes.

At the same time, the stock market failed to complete a late-year rally after the major indexes dropped more than 20% this past summer. This makes commercial real estate (and multifamily housing in particular) look good compared to the risk inherent in other asset classes.

As JPMorgan Chase & Co. noted in its 2023 commercial real estate outlook, “Multifamily [housing] is currently the highest performing of all asset classes.” The bank was referencing Moody’s Analytics data that placed the U.S. multifamily vacancy rate at 4.4% in third-quarter 2022 — a five-year low — and its analysts included both multifamily and affordable housing as top real estate trends for this year.

Even brick-and-mortar retail has appeared to stem the tide of rising vacancies. As noted by Moody’s, national vacancy rates for neighborhood and community shopping centers stayed flat at 10.3% for the fifth straight quarter to end last year. Regional and super regional mall vacancies rose slightly to 11.2% in Q4 2022, identical to the levels seen at the end of 2021.

There is a silver lining to most clouds. In this case, as higher interest rates push up the cost of multifamily developments and stricter lending standards lower investment returns, the same trends will compel more Americans to remain renters — many in multifamily properties. Underlining this point is a June 2022 report from John Burns Real Estate Consulting, which estimated that owning a single-family residence cost $839 per month more than renting one.

Never in the past two decades has it been so relatively expensive to own a home versus renting one, the report showed. As a result, renters are staying put.

Where to invest

It’s little wonder that, despite the challenges, multifamily mortgage lending was projected to finish last year at nearly $440 billion, up more than 700% from the height of the financial crisis in 2009. Mortgage brokers will want to help their clients who are interested in this sector to make the right decisions. And probably the first question their clients will ask is, “Where do I invest?”

The answer might not be what you expect. According to national real estate brokerage Redfin, apartment rents increased 9% year over year in September 2022, significantly slower than earlier in the pandemic but still a healthy clip. And although much publicity has been focused on the post-pandemic flight to the suburbs, large and medium-sized cities (many in the Sun Belt) made up the bulk of Redfin’s list of the fastest-growing markets for rental income.

The top location was a surprise: Oklahoma City at more than 24% growth this past September. Pittsburgh came in second as rents there increased by 20% year over year. Indianapolis; Louisville, Kentucky; and Nashville rounded out the top five. New York City rents grew by more than 15%, enough to earn eighth place on Redfin’s list.

In other words, millions of people still crave the urban lifestyle. Also, today’s multifamily operations do not always house full-time residents. For more than a decade, urban housing has amassed an entirely new source of demand from short-term rental sites such as Airbnb, as well as short-term corporate housing platforms like Blueground.

By any measure, demand is robust for multifamily units. When it comes to mixed-use properties, demand for the retail spaces beneath these homes seems to have held up remarkably well. Temporary tenants, who presumably like to get out and about, may be helping to make up for fewer office workers in city centers by fueling demand for ground-floor restaurants, shops and convenience stores. In general, the economic future for brick-and-mortar stores continues to brighten.

Sales growth for these stores outpaced e-commerce growth in 2021. Total retail sales were up 6.5% year over year in November 2022. And the National Restaurant Association reported that sales at eating and drinking establishments reached $90.4 billion in November 2022, a fourth consecutive month of significant increases. This volume was more than $37 billion higher than in November 2020, when the pandemic was raging.

Affordability struggle

The strength and durability of multifamily housing might seem to fly in the face of one trend: The size of U.S. households has been shrinking for decades, from an average of 3.3 people per household in 1960 to only 2.5 people per home last year.

While there are plenty of ways to extrapolate this data, the bottom line is that smaller households combined with a growing population equates to the need for more housing units. But with fewer people in each home, there are fewer people available to pay a mortgage and other household expenses.

Affordability, therefore, is the No. 1 issue for the majority of American households that rent. Multifamily properties presently offer the best deal by far. We may not become a nation of communal living, but we will likely be sharing more walls for a long time to come.

This issue is one to keep in mind for commercial mortgage brokers and borrowers who are interested in the multifamily sector. Consider that this past November, Fannie Mae and Freddie Mac were given the green light to guarantee mortgages of more than $1 million in select locations. This move probably won’t do much to make a “McMansion” more affordable, but it does illuminate just how expensive it has become these days to buy a home in desirable parts of the country. Owning a single-family house is simply not an option for many people.

As 2022 came to an end, lumber prices returned to pre-pandemic levels and 30-year fixed mortgage rates inched down after peaking above 7% in November. Early this past January, they had fallen below 6.5%, partly because the inflation rate appeared to peak in October and was beginning to fall. Many market observers expect a lower inflation rate to reduce pressure on the Federal Reserve to further raise rates.

● ● ●

Although it’s impossible to know what the long-term trajectory will be for inflation and interest rates, mortgage brokers should understand that the argument for multifamily housing investments remains convincing. The long-term trends in household formations favor multifamily and the demand for rentals is strong. Prices for single-family homes continue to be out of reach for many buyers, requiring a greater focus on renting. As the pandemic fades and supply chains get back on track, developers and builders are finally catching a break. And that’s a good thing for investors, tenants and the economy at large. ●

Author

-

Lazer Sternhell is CEO of Cignature Realty. He grew up in a family of commercial real estate owners. Working for his family’s business in the mid-1990s, he gained invaluable knowledge while cultivating a natural talent for sales. He went on to establish and run several successful businesses in other industries. His familiarity with commercial spaces ultimately inspired him to become a commercial real estate broker. He was previously awarded the title of CoStar Power Broker.

View all posts