Reis’ 2018 year-end apartment statistics show a higher national vacancy rate of 4.9 percent, up from 4.6 percent at the end of 2017. The increase was due to another year of inventory growth (2.2 percent) that was only partially offset by occupancy growth of 2 percent.

This higher vacancy rate, however, obscures the fact that occupancy growth was still higher in 2018 than in 2017. A total of 204,900 units were absorbed in 2018, well above the 187,600 units absorbed in 2017, but still below the 216,100 units absorbed in 2016.

Indeed, while tenant occupancy decelerated in 2017, it rose again in 2018 due in part to rising mortgage rates as well as the Tax Cuts and Jobs Act signed at the end of 2017. The new tax law not only lowered the state and local tax-deductibility ceilings, it also doubled the standard deduction, which reduced the incentive to take the mortgage interest deduction. This, in turn, lowered the incentive to buy a home for many prospective buyers.

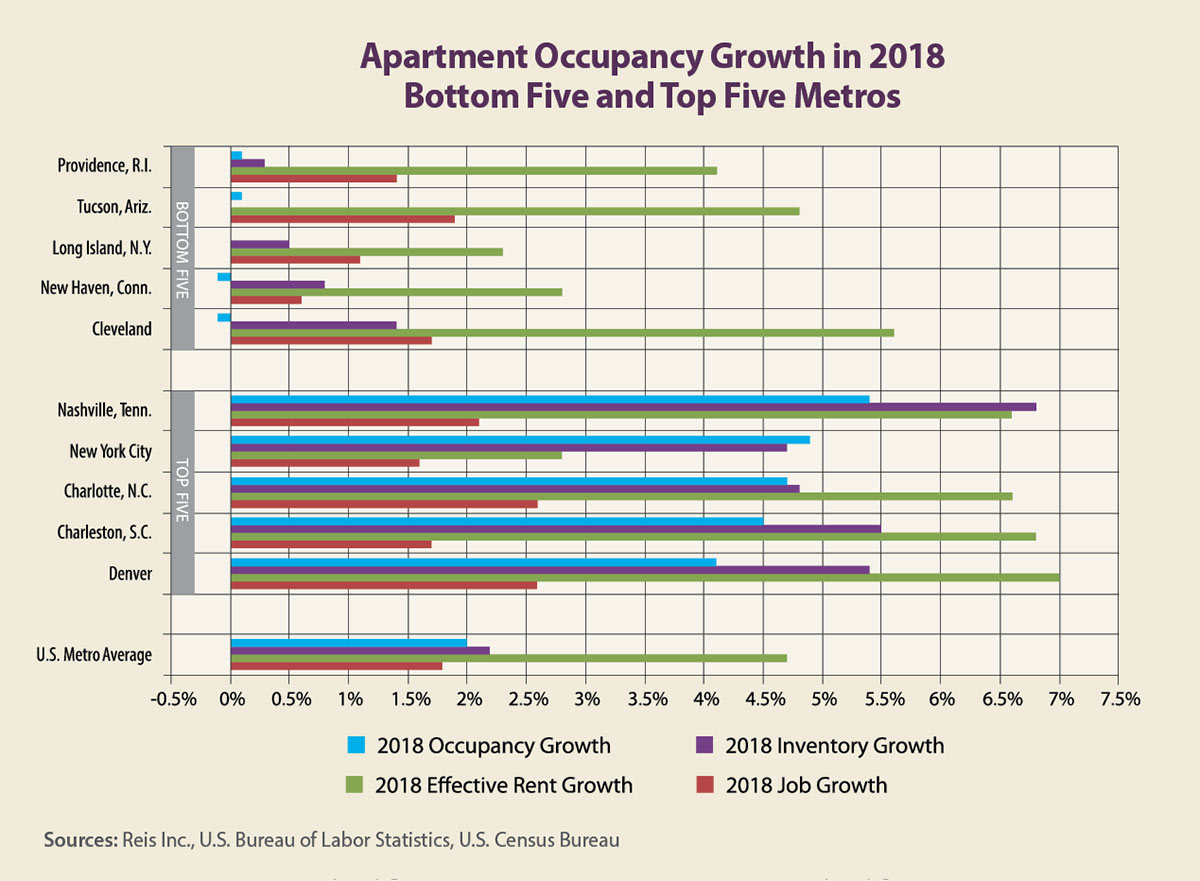

We had written about this likelihood a year ago when the tax- reform act was passed, but the metros we had thought would see the most apartment occupancy growth — such as those in suburban, high-tax states like New York and Virginia — did not see the highest occupancy growth, not even after correcting for inventory growth. Rather, the metros with the highest occupancy-growth rates were those that saw strong inventory growth as well as strong job growth.

The metros with the highest occupancy growth also saw some of the fastest job growth in 2018, and these metros saw strong inventory growth as well. In fact, the correlation coefficient for 2018 inventory growth and occupancy growth was 91 percent. The equivalent measure for occupancy growth and job growth was 29 percent; for occupancy growth and rent growth, it was 31 percent.

Metros that saw the slowest occupancy growth also saw healthy job growth, but these metros saw much less inventory growth than those at the top of this list. This suggests that people who acquired a job or saw higher income growth may have bought a house instead of renting an apartment.

Indeed, in the high-tax state of New York, those living in New York City may have put off buying a home, but few, if any, left the Big Apple to rent in Long Island even though the average rent in Long Island is 42 percent lower. Note that the effective rent-growth rate in Long Island was the same as in New York (2.8 percent) and both are considerably lower compared to other high-growth metros.

In short, the impact of the tax changes may have pushed more people into the apartment market than the housing market in 2018. This likely affected those who needed to move for a new job or other life change. Moreover, the stronger job growth of 2018 may have pushed many to upgrade to a nicer, newer apartment and put off buying a home.

The outlook for 2019 is more of the same as apartment inventory growth is expected to grow another 2.2 percent. We forecast similar occupancy growth in 2019 to that of 2018. The expected 2019 occupancy growth is also in line with expected job growth, as well as a continued preference for renting over owning, regardless of local tax rates.

Author

-

Victor Calanog is chief economist and senior vice president for research at Reis Inc. (www.reis.com). He writes a monthly column on property types for Scotsman Guide. Calanog and his team of economists are responsible for data models, forecasting, valuation and portfolio services for clients in commercial real estate.

View all posts