Looking back at 2021, Moody’s Analytics Reis data shows that the performance of all major commercial real estate sectors were on the rise. The multifamily housing sector posted record-breaking rent growth for the year. The office and retail sectors appeared to be evolving, given changes in the appetites for these properties. The industrial sector, which greatly benefited from the boom in e-commerce, weathered the waves of COVID-19 variants. And the recovery for hotels beat expectations as the national occupancy rate and average daily rate rose quickly amid rising inflation.

Meanwhile, as expected, the senior-housing sector also had quite a ride through the second year of the pandemic. Senior-housing residents were especially vulnerable when COVID hit, as many have preexisting medical conditions that make this group much more prone to severe or deadly infections.

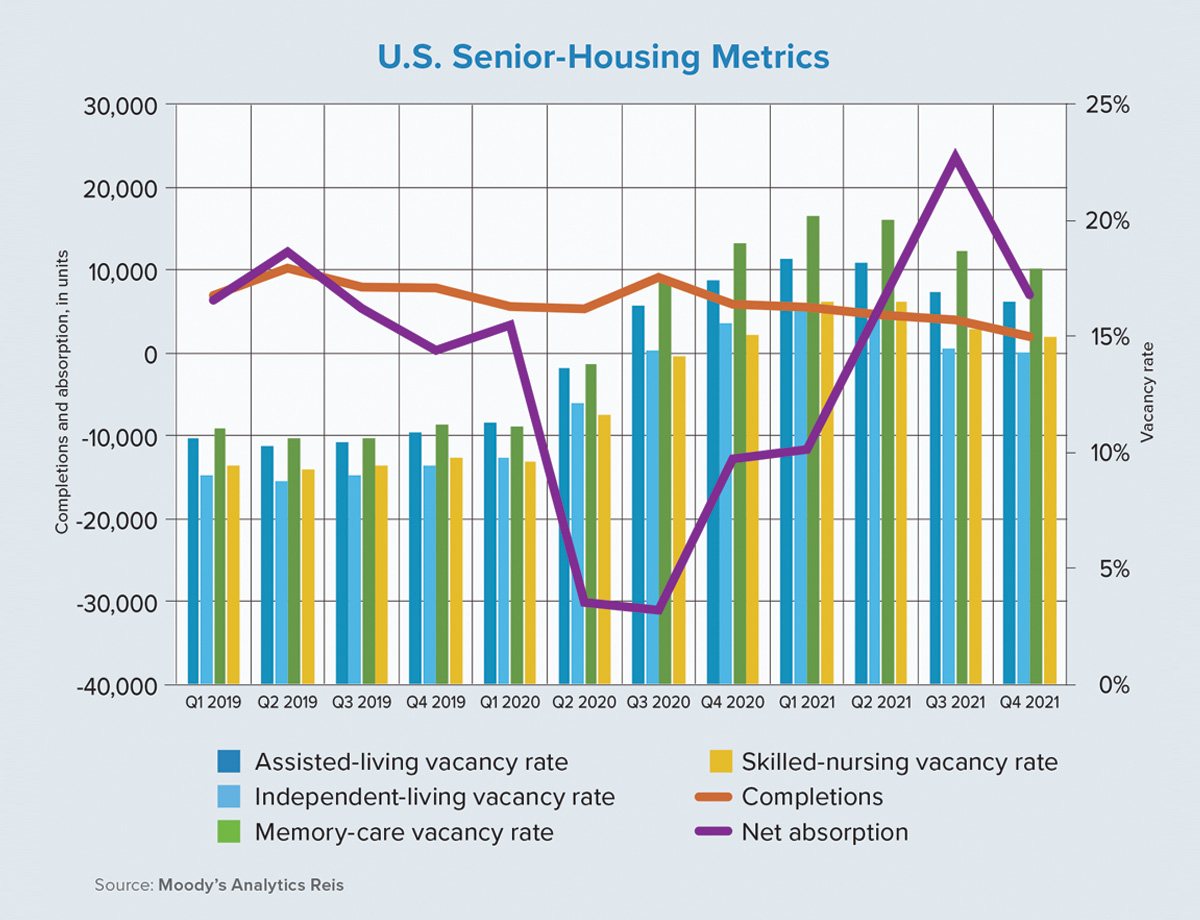

As COVID cases quickly spread across these communities, they triggered concerns for residents and caused staffing shortages, so the demand for senior housing cooled instantaneously. The net absorption rate, which measures the number of residents moving in versus those moving out, flipped to negative territory in second-quarter 2020 and erased all gains for 2019 in a matter of three months.

Market stress continued to be elevated until vaccines were made available to the 65-and-over population. The U.S. senior-housing vacancy rate peaked at 17% in Q1 2021 — nearly double its five-year, pre-pandemic average. Due to vaccine mandates among residents and staff members, the demand for assisted- living, independent-living, memory-care and skilled-nursing facilities quickly strengthened starting in Q2 2021. Net absorption for this sector increased by nearly 300% from the second to the third quarters of last year, reaching its highest level in our nearly 10-year tracking history.

Over the course of 2021, the national sector recouped more than one-third of its occupancy losses from 2020. At the same time, a quick pickup in demand coupled with rising expenses for care served as a tailwind to propel rent growth. Annualized growth in asking rents across all four types of care facilities ranged from 1.5% to 2.1% in 2021 versus 1.3% to 1.4% in 2020. According to Senior Housing News, accelerated rent growth was mainly driven by

higher wages and difficulties in attracting and retaining qualified workers to this industry.

On the supply side, the construction pipeline tightened as a direct result of increased investor caution around senior housing due to weakness in sector fundamentals, labor shortages and supply chain disruptions. Total completions were down 38% from 2020 to 2021 while the 16,053 units added last year was the lowest number since 2014. A strong rebound in demand along with weak inventory growth pushed down the vacancy rate to 15.3% at the end of 2021, which was much higher than its pre-pandemic level of 10%. Three straight quarters of declining vacancy rates, however, clearly signaled a recovery in motion.

At the metro level, each of the 100 largest U.S. markets saw vacancies move away from their respective pandemic-era peaks. Memphis and Springfield, Massachusetts, recorded the two largest vacancy declines among these cities in 2021. New York City, San Francisco and Albany, New York, had the lowest vacancy rates in the senior-housing sector at the end of last year.

Across the sector’s four segments, memory- care facilities have been under the most pressure since 2020. Due to more requirements for specialized living designs and trained staff, memory care has gone through more challenges and has lagged the other three senior-housing segments, recording the highest level and steepest increase in its vacancy rate. At the other end of the spectrum, independent-living facilities have been more resilient during the pandemic, leading the sector’s overall performance with the lowest vacancy level and sharpest vacancy decline.

COVID-19 cases, ongoing staffing shortages and supply chain disruptions remain important factors that continue to drive short-term supply and demand in the senior-housing sector. Two years into the pandemic, improved safety protocols are resuscitating demand for these properties while the “Great Resignation” and high costs for construction materials are weighing down inventory growth. ●

-

Lu Chen is a senior economist at Moody’s Analytics CRE. She has deep knowledge of urban economics and credit risk with special interests in senior housing and urban migration.

View all posts