Historically speaking, the performance of the self-storage sector has been highly correlated with population growth and household formation. When population growth decelerates, the self-storage vacancy rate tends to trend upward, while the reverse also is true.

Consistent with these historic trends, the U.S. self-storage vacancy rate peaked in 2020 in response to the slowing population growth of prior years. Since then, the rate has been trending downward as population growth has rebounded and household formation has accelerated. At 10.4% in second-quarter 2022, the self-storage vacancy rate dropped below its long-run average for the first time in five years.

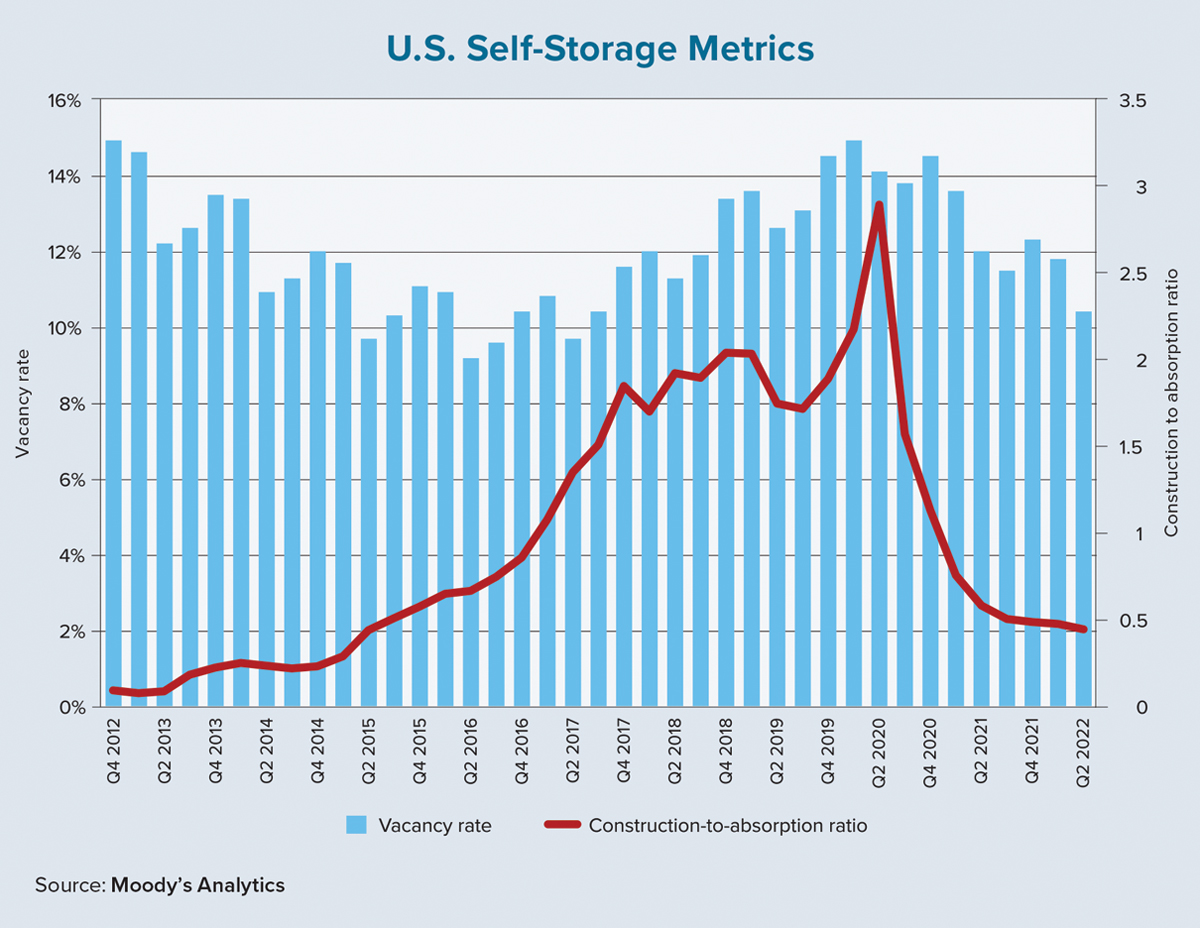

In addition to the demand side of the equation, supply-side variation (particularly the relative strength between supply and demand) is responsible for the sector’s long-term performance trend. As the chart on this page shows, the construction-to-absorption ratio was below 1-to-5 in the early 2010s, meaning that fewer than one unit was added for every five units of demand for self-storage space. This supply shortage incentivized rapid investment growth in the self-storage sector, so construction activities accelerated and eventually peaked in 2018.

The chart also illustrates that the construction-to-absorption ratio exceeded 1-to-1 in 2017 and topped out at nearly 3-to-1 in Q2 2020, simultaneously driving up the sector’s vacancy rate. In other words, when the COVID-19 pandemic started, demand for one unit of self-storage space was supported by the delivery of nearly three new units.

But widespread supply chain challenges and labor shortages quickly cooled the investment landscape. Over the past two years, deliveries plunged while demand heightened. The construction-to-absorption ratio fell below 1-to-2 in the first half of this year, pushing the vacancy rate near single-digit range.

In addition to following the general economic trend, the self-storage sector also shows strong seasonality within a given year. Leasing activities usually tick up in the summer when more families are moving and college students are leaving campus at the end of the school year. The national vacancy rate has always gone up in the third and fourth quarters of the year. Meanwhile, rent growth for both climate-controlled and non-climate-controlled units usually correlates with changes in vacancies. Rents go up during lower vacancy periods and down when vacancies rise.

Due to anomalously high pandemic-related relocations and unprecedented multifamily market growth last year, the self-storage vacancy rate bucked its historic trend and declined for three straight quarters. Similarly, the rhythm of rent changes also was temporarily distorted. Asking rents for each type of self-storage unit dipped in the first six months of 2020 before edging up nearly unabated (and without a seasonal decline) through Q2 2022.

A detailed metro-level analysis of the self-storage sector shows a more nuanced picture. Moody’s Analytics segmented its self-storage markets based on the performance of the local multifamily market and designated two types of locations: hot metros and expensive metros.

The first category is comprised of the 20 metros with the fastest apartment rent growth from February 2020 to March 2022. Sun Belt cities (Phoenix; Jacksonville; Albuquerque, New Mexico; Tucson, Arizona; and Tampa-St. Petersburg) top this list. The second category includes the 15 metros that had the highest apartment rents in February 2020, prior to the pandemic. New York City, San Francisco, San Jose, Boston and Oakland led the way here.

Expensive metros are established markets that have exhibited stability and resilience in the self-storage sector. But the pandemic has boosted this sector’s performance in hot metros. Vacancy declines and rent growth for hot metros have exceeded those of expensive metros.

We are cautious about the growth potential for rapidly growing areas (aka hot metros) as multifamily affordability issues put pressure on relocation decisions. The U.S. self-storage vacancy rate should continue to trend downward as population growth and multifamily markets stabilize. Rents for 10×10 climate- and non-climate-controlled units grew last year by 9.8% and 8.2%, respectively, but they will likely revert to the 2% growth range in the near term. ●

Author

-

Lu Chen is a senior economist at Moody’s Analytics CRE. She has deep knowledge of urban economics and credit risk with special interests in senior housing and urban migration.

View all posts