These are uncharted waters indeed. The economic fallout from COVID-19 will be more widespread than that of 9/11 or hurricanes Sandy and Harvey, and possibly deeper than the recession of 2008-2009. This global pandemic and subsequent downturn is a force majeure that was nearly impossible to predict or prepare for. And yet economists are trying to decipher how and when the economy will recover while donning masks and gloves, and maintaining social distancing. As of this writing in late March, the coronavirus was not contained or waning.

Although no one disputes that a recession is ahead of us, many wonder how the fallout from COVID-19, including the subsequent shutdown of businesses and services, will impact the U.S. commercial real estate market. Many businesses, both large and small, are struggling to pay rent in addition to salaries and other expenses. The recently passed $2 trillion coronavirus stimulus bill was designed to help small businesses and renters cover their bills, but for how long was not yet clear.

Given the unprecedented circumstances, Moody’s Analytics Reis has issued updated scenarios for critical and severe economic downturns, as well as for a protracted slump. We also have generated metro-level and submarket-level forecasts for each of these three scenarios based on the 20- to 30-year data trove in our arsenal. These are sobering numbers indeed.

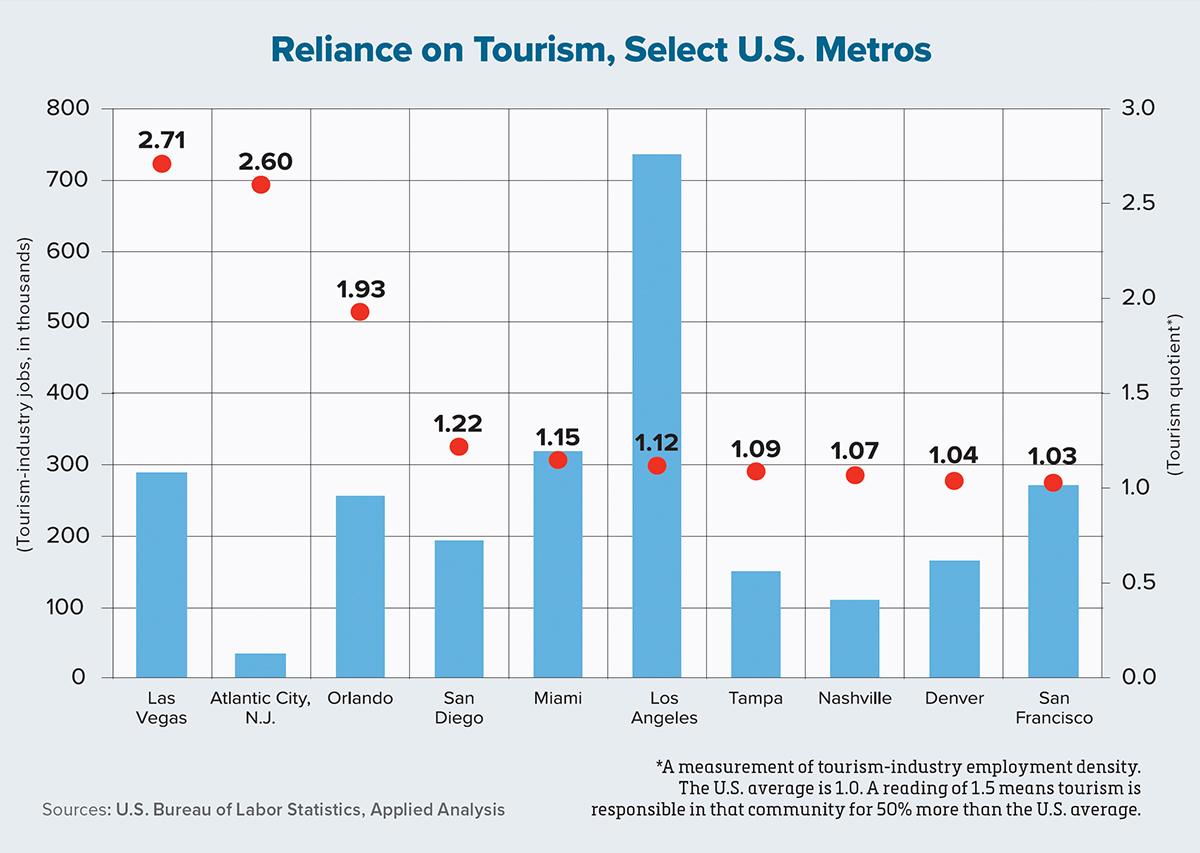

Across the numerous requests for information and analyses we have been asked to provide, one metric that is being used to compare metro areas is the share of leisure and hospitality jobs. The U.S. metros with the largest shares — such as Las Vegas, Orlando and other parts of Florida — will suffer disproportionately compared to other metros that are less reliant on their tourism industries. This still leaves much uncertainty, however, in regard to the rest of the U.S economy.

We have therefore created a separate metric to show how some metros might outperform others based on an economy that has more stable, recession-proof industries. Make no mistake — each metro will face job losses, but some may lose fewer than others because their government, health care and education sectors are less at risk of shedding significant numbers of jobs than those more heavily dependent on tourism. One also could argue that metros with large professional- and business-services sectors will have less exposure to severe job losses.

With these parameters, we can rank metros that have a better chance of losing fewer overall jobs. Metros that have large combined shares of education-, health- and government-sector jobs are Washington, D.C.; Sacramento; New Haven, Connecticut; and the New York cities of Syracuse and Rochester. Not surprisingly, the last three metros on that list are known for being college towns, but they also have large health care systems. SUNY Upstate Medical University and Rochester Regional Health are large employers in their respective markets.

A number of state capitals also rank high on this list, but some were not as high as one would expect. Phoenix, for example, ranked 64th out of 82 metros studied for this measurement. Washington, D.C.’s score, meanwhile, was much higher than many other metros.

Looking exclusively at the professional- and business-services sector, however, results in much different rankings. Metros with high shares of employment in these industries include suburban Virginia, San Francisco, Washington, D.C., San Jose and Boston. In San Francisco and San Jose, this sector has had more volatility in the past than many metros due to these cities’ reliance on technology companies. Will the next recession be any different, or can tech behemoths such as Google and Facebook help shelter their local economies from significant job losses?

Only time — and the potential for significant government support — will tell how the economy fares going forward. These measurements could shine a light on how U.S. metros will perform over the next year or so. It will be a long road ahead, but we are all in this together.

Author

-

Victor Calanog is chief economist and senior vice president for research at Reis Inc. (www.reis.com). He writes a monthly column on property types for Scotsman Guide. Calanog and his team of economists are responsible for data models, forecasting, valuation and portfolio services for clients in commercial real estate.

View all posts