One commercial property type that does not garner much attention is the student-housing sector. Niche investors in this asset class know that some student-housing properties can be very safe investments, given the rising demand for a college degree.

As development has been significant in a number of markets, however, student-housing owners have had to keep a lid on rent growth in some markets because of slowing enrollment. As college costs have soared over the past few decades, enrollment growth for these schools has been spotty — especially large public universities, according to the National Center for Education Statistics.

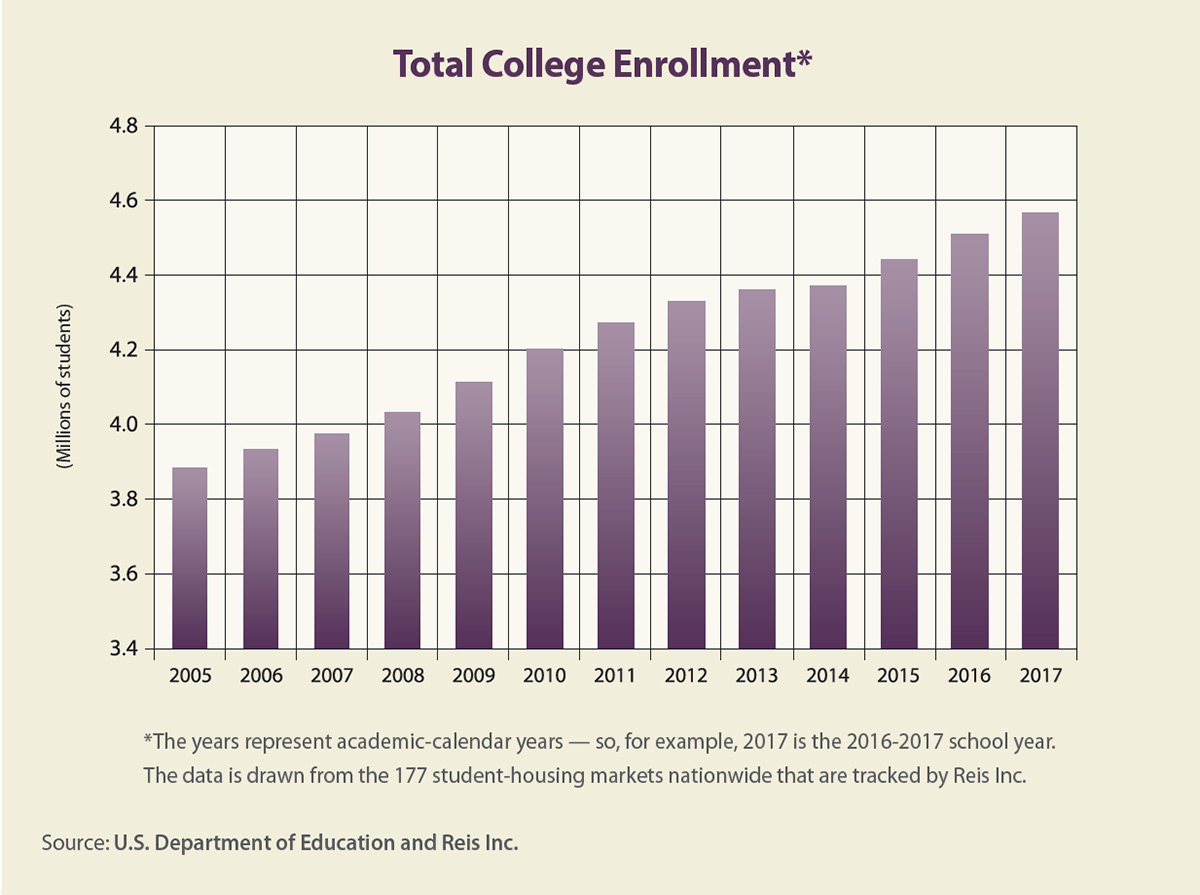

Taking a look at Reis statistics for 177 student-housing markets across the U.S. for which we have enrollment data, from the fall of 2016 to fall of 2017, enrollment in these schools grew by 1.2 percent. In fact, the 2016-2017 school year was the 12th consecutive year of enrollment growth, as represented in the chart on this page.

Overall, enrollment growth has resulted in rising demand for student-housing properties, which has been reflected positively in market fundamentals each year. Reis monitors student-housing properties on a fall-to-fall basis to reflect the typical lease term that students are given for the school year.

Property fundamentals in this sector also are split into two distinct categories: properties that rent by the bed and properties that rent by the unit. In properties that rent by the bed, students are responsible for their individual lease, while in properties that rent by the unit, students have joint-housing contracts for the entire unit.

The supply and demand trends for the two property types differ. Thus, for a more accurate understanding of the way the sector is performing, we have split the two sets of properties. Occupancy has been typically higher for properties that rent by the unit, although this property type also has seen less inventory growth than properties that rent by the bed.

In the 2017-2018 school year, inventory for properties that rent by the bed increased by 33,794 units, or 4.3 percent. Properties that rent by the unit increased by 955 units, or 0.4 percent.

With strong occupancy growth, the vacancy rate for properties renting by the bed declined this past fall from 5.9 percent to 4.9 percent. Properties renting by the unit experienced an increase in vacancy, from 2.5 percent to 2.6 percent, but this rate is expected to decline in the coming year — down to 2.4 percent.

These low vacancy rates indicate that the increase in enrollment is providing adequate demand to meet the incoming growth in supply.

In terms of national rent growth, both properties leased by the unit and properties leased by the bed saw a rental-price increase of 3.1 percent in the 2017-2018 school year. Both property types have seen positive rent growth in recent years and are expected to experience even higher rent growth in the coming year because of an additional influx of new units coming onto the market that are still expected to be absorbed.

Some college markets are growing faster than others, including schools in California, Texas and the state of Washington. Others, however, have seen rent declines, including many in the Midwest. In other words, while college enrollment growth should spur further rent growth, investors should consider other local factors when investing in student housing.

Author

-

Barbara Byrne Denham is former senior economist and associate director at Moody’s Analytics. She previously served as chief economist at Eastern Consolidated and is a Ph.D. candidate at New York University, where she has studied economics, monetary theory and game theory.

View all posts