With the announcement that it has chosen two locations for its new headquarters operations — Queens in New York City and Crystal City in suburban Virginia — Amazon has ended the suspense of a long search process.

Although the selection of the two East Coast cities may have surprised many, the criteria laid out in the company’s original request for proposals (RFP) in September 2017 clearly indicated what Amazon was looking for in its quest: a large cosmopolitan city where it could scale up operations in a short period of time.

In Reis’ white paper, “Amazon HQ: Location Decision and Scoring Analysis,” we followed the criteria and came up with a measure for all of the quantitative and qualitative specifications listed in the Amazon RFP, then tabulated the results. Our final list included New York City as No. 1 and suburban Virginia as No. 6 (with Washington, D.C. coming in third). So, Reis’ research shows that Amazon followed its criteria in selecting these two cities.

In short, these two locations feature the three main requisites for scaling up operations: access to labor, access to public transportation and space. The concern many have, of course, is that these added jobs will drive real estate rents up in two areas where the costs are already very high.

This concern is rational. These two areas, however, also have two of the highest rates of apartment and other multifamily construction — either underway or in planning stages — in the U.S.

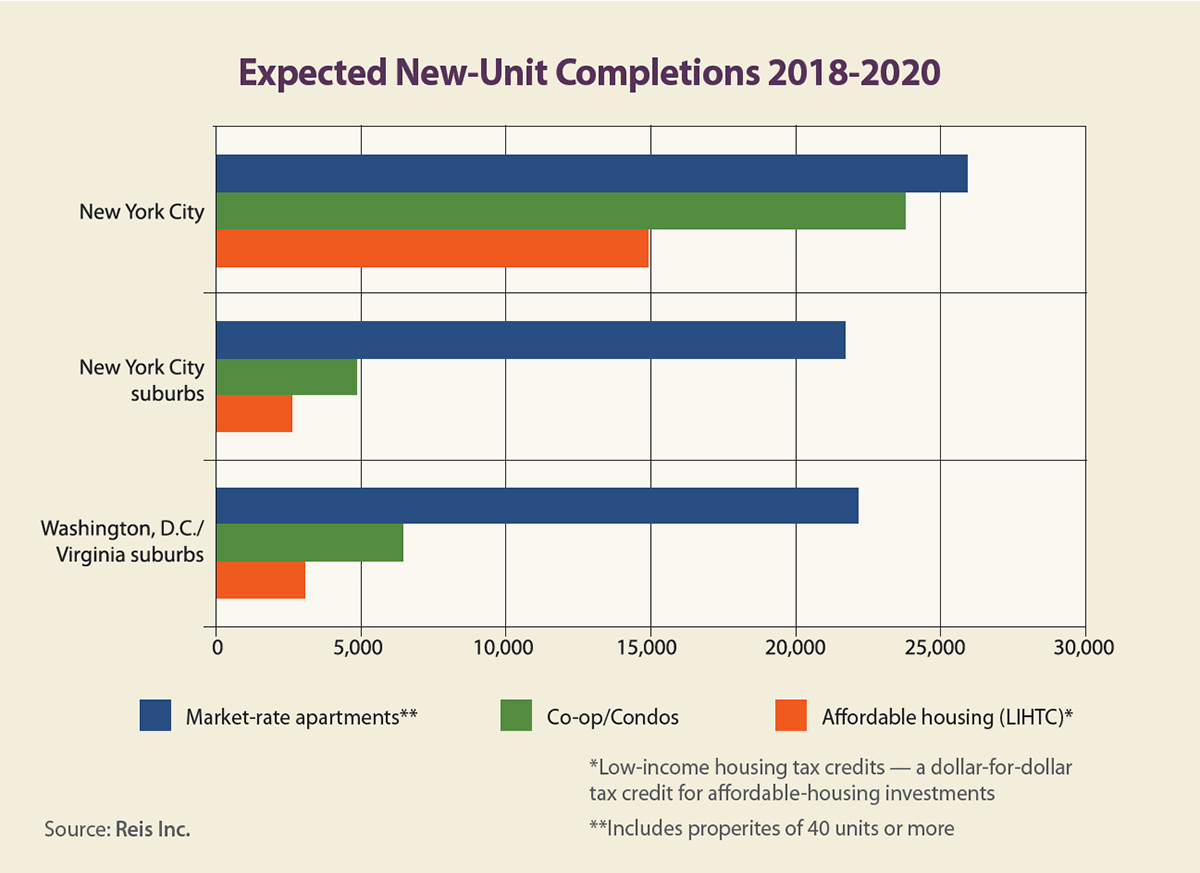

Reis new-construction data shows that suburban Virginia is expected to add close to 10,000 apartment units from 2018 through 2020, while Washington, D.C. is expected to add another 12,300 apartment units over the same three-year period. Combining these totals yields a 7.5 percent growth rate in apartment inventory for the region.

In New York City, construction underway is expected to add 25,900 units from 2018 through 2020, a growth rate of 12.5 percent, while the New York City suburbs are projected to add another 21,700 units for a 5.3 percent growth rate. The equivalent growth rate at the national level is only 5.5 percent.

Yet these numbers only include market-rate properties. Reis also tracks data related to co-op/condominium construction, which is expected to add another 6,400 units in suburban Virginia and Washington, D.C., from 2018 through 2020, as well as 23,700 units in New York City and another 4,900 units in the surrounding suburbs.

Finally, Reis’ affordable-housing construction data shows that Washington, D.C., and suburban Virginia together are expected to add 3,060 units of affordable housing from 2018 through 2020. New York City is expected to add 14,900 affordable units over the three-year period, with the New York City suburbs expected to add another 2,600 units of affordable housing.

The Reis forecasts for occupancy growth in suburban Virginia and New York City will likely be adjusted to reflect the impact from Amazon’s expansion. Our current forecasts show rising vacancy rates in both metros as supply growth had been expected to outpace demand growth. The new-occupant growth driven by Amazon’s arrival in Queens (in New York City) and Crystal City (in suburban Virginia) will surely increase occupancy growth in their respective metros.

With that said, developers are probably already looking to build even more housing in Queens and elsewhere in New York City, as well as suburban Virginia, given Amazon’s announcement. With so much expected construction already underway in the locations Amazon has selected for its HQ2 operations, vacancy rates are not projected to plummet. They will probably decline, but at a slower rate than many would expect.

Author

-

Victor Calanog is chief economist and senior vice president for research at Reis Inc. (www.reis.com). He writes a monthly column on property types for Scotsman Guide. Calanog and his team of economists are responsible for data models, forecasting, valuation and portfolio services for clients in commercial real estate.

View all posts