While the media provides regular updates on the status of the tariff wars with China, the industrial real estate sector continues to hum along, showing very little impact from any trade disputes.

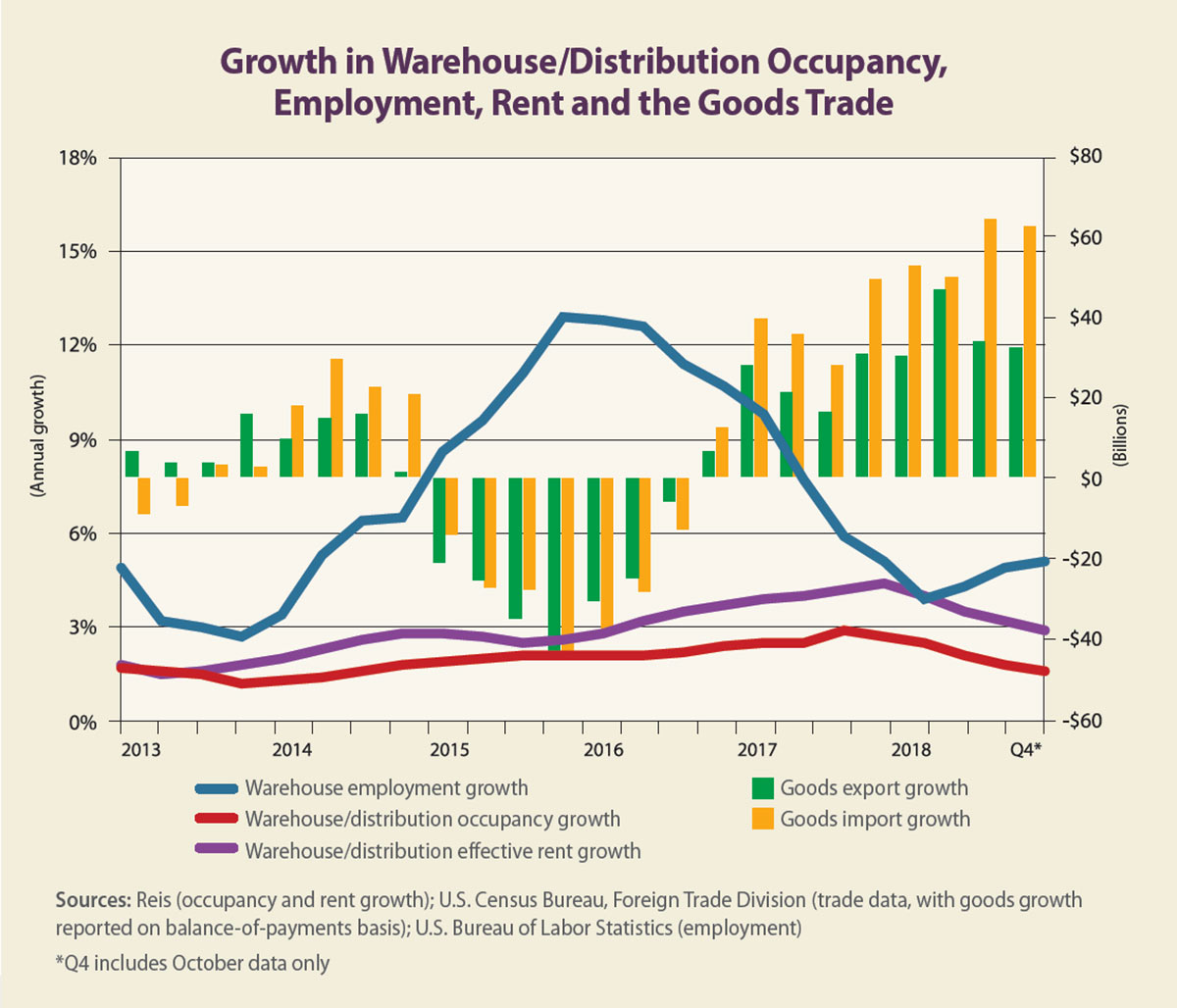

To be sure, occupancy growth in the warehouse/distribution sector decelerated in 2018 after robust growth in 2017, but growth was nevertheless positive every quarter. Reis Inc. and other analysts attributed the industrial-sector slowdown in the first half of 2018 to the fears of a trade war and the concern that lower trade volumes would reduce the demand for warehouse/distribution space. Was this analysis accurate?

The trade in goods increased in each of the first three quarters of 2018. These trade numbers seem to defy the forecasts for stalled growth stemming from the higher tariffs. Trade is a complicated segment of the economy and is difficult to measure. Aggregate trade is measured in dollar volume and is impacted by currency values as well as commodity prices.

Indeed, the decline in goods trading in 2015-2016 was partly attributable to a decline in commodity prices. Thus, although the dollar value of trade declined in those years, it does not necessarily mean that the physical volume of goods declined as well.

Likewise, the increase in the dollar volume of trade in 2018 may or may not correspond to gains in the physical volume of trade. Nevertheless, it is surprising and it suggests that the fears of a trade war may be simply that — fear.

The growth in goods trading is consistent with employment statistics for the warehouse and storage industry. That may be the more relevant measure for warehouse/distribution demand. In fact, employment growth soared during much of the last five years.

Since 2013, the industry has added 340,000 jobs for a growth rate of 49 percent. This corresponded with steady occupancy growth, along with rent growth that accelerated in 2017.

Warehouse/distribution occupancy grew by 604 million square feet from 2013 to 2018, a cumulative growth rate of 11.1 percent. The cumulative effective five-year rent growth was 17.4 percent. This exceeds the five-year cumulative rent growth for office properties (14.5 percent) as well as retail (9.6 percent), but trails the five-year apartment-market rent growth of 24.6 percent.

Not surprisingly, the bigger the market, the higher the growth.

San Bernardino/Riverside, California, recorded the highest occupancy growth along with Atlanta and Chicago. Metros with the greatest rent growth in 2018 included San Bernardino/Riverside; the Florida cities of Orlando and Jacksonville; Sacramento, California; and Kansas City, Missouri — which each posted growth rates of 4 percent to 4.9 percent during the year. No metro saw a rent decline last year.

Another finding of interest is that employment growth in the warehouse/distribution sector accelerated a bit in 2018, just when occupancy growth decelerated. There could be a lagged impact of one variable upon the other.

The overall picture in the warehouse/distribution sector and with trade-related statistics, however, suggests that occupancy growth should continue to expand this year and beyond. It also suggests that any news on tariffs and the trade war should be taken with a grain of salt.

Author

-

Victor Calanog is chief economist and senior vice president for research at Reis Inc. (www.reis.com). He writes a monthly column on property types for Scotsman Guide. Calanog and his team of economists are responsible for data models, forecasting, valuation and portfolio services for clients in commercial real estate.

View all posts