Funding In A Flash

Reading Time: 4 minutesThe SBA’s fast financing program can help small businesses

Scammers Are on the Prowl

Reading Time: 5 minutesRising interest rates provide more cover for cybercriminals

Residential Spotlight: Atlantic Region

Reading Time: 6 minutesEast Coast states are holding steady despite headwinds.

John E. Bell III, U.S. Department of Veterans Affairs

Reading Time: 3 minutesVA loans emerge as attractive option in a shifting market

Ashley McKenzie-Sharpe, Neo Home Loans

Reading Time: 3 minutesNo. 17 Most Loans Closed, No. 28 Top Women Originators

2022 State Champions

Reading Time: 3 minutesThese originators are experts in their local markets

Seize the opportunity of newfound downtime

Reading Time: 3 minutesUsername or E-mail Password Remember Me Forgot Password

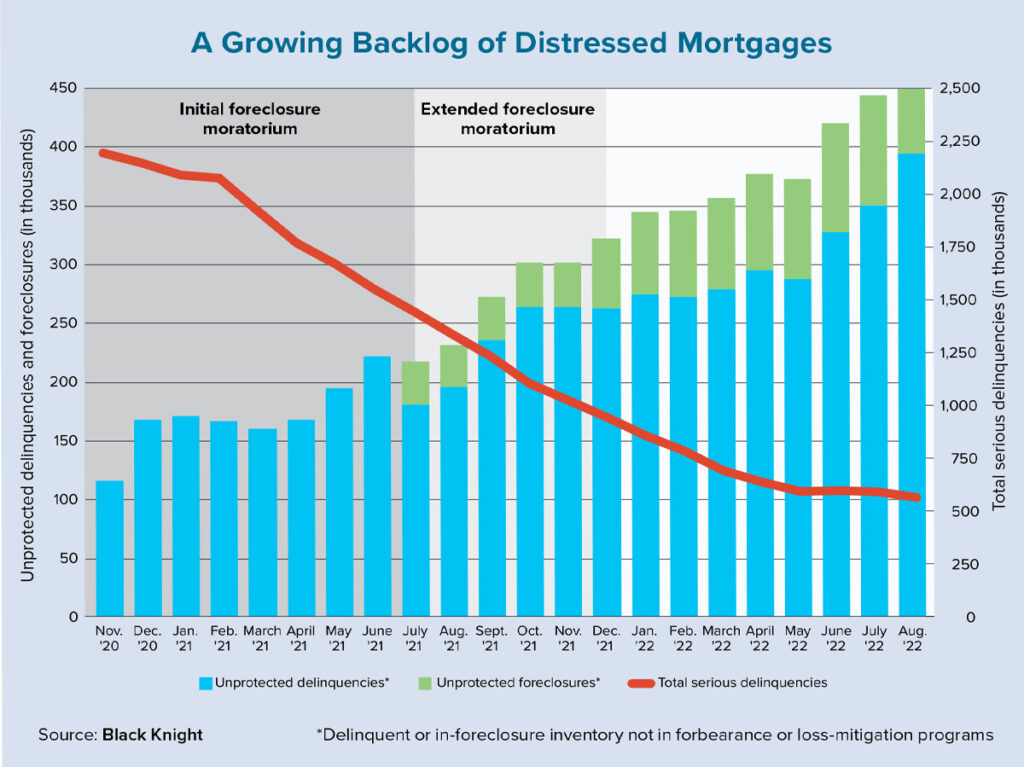

Foreclosures could spike if dire predictions come true

Reading Time: 2 minutes

A Storm Brews in Florida, Even After Hurricane Ian

Reading Time: 4 minutesThe state’s mortgage market faces a litany of challenges exacerbated by extreme weather

Get Your Client in the Front Door

Reading Time: 3 minutesNon-QM products may be the best option for a generation of self-employed workers