With core inflation reaching a scorching 40-year high and real disposable personal income trending back to pre-pandemic levels, housing affordability has become a major topic in 2022. According to a Moody’s Analytics report from the third quarter of this year, the proportion of rent to household income (aka rent burden) went up in 90% of the nation’s 79 primary metros since the beginning of 2020.

As we closely monitor the performance of the single-family and multifamily housing markets, a supply shortage and an affordability crisis (especially for lower-income households) has come into sharp focus. The affordable housing sector — defined here as units funded by the federal Low-Income Housing Tax Credit (LIHTC) program — accounts for roughly 10% of the U.S. multifamily market.

With new units typically built by partnerships between the public and private sectors, affordable housing inventory was growing at an average yearly rate of 3.3% before the COVID-19 pandemic hit. But affordable housing construction experienced major delays over the past two years due to factors that have plagued the entire commercial real estate industry: supply chain disruptions, labor shortages, and higher costs for labor, materials and mortgage capital. Affordable housing growth over a rolling 12-month period had receded to 2.5% by the first half of this year, the slowest growth since Moody’s Analytics started tracking this sector in 2015.

Waitlists for affordable housing are strong measurements for the level and stability of demand.

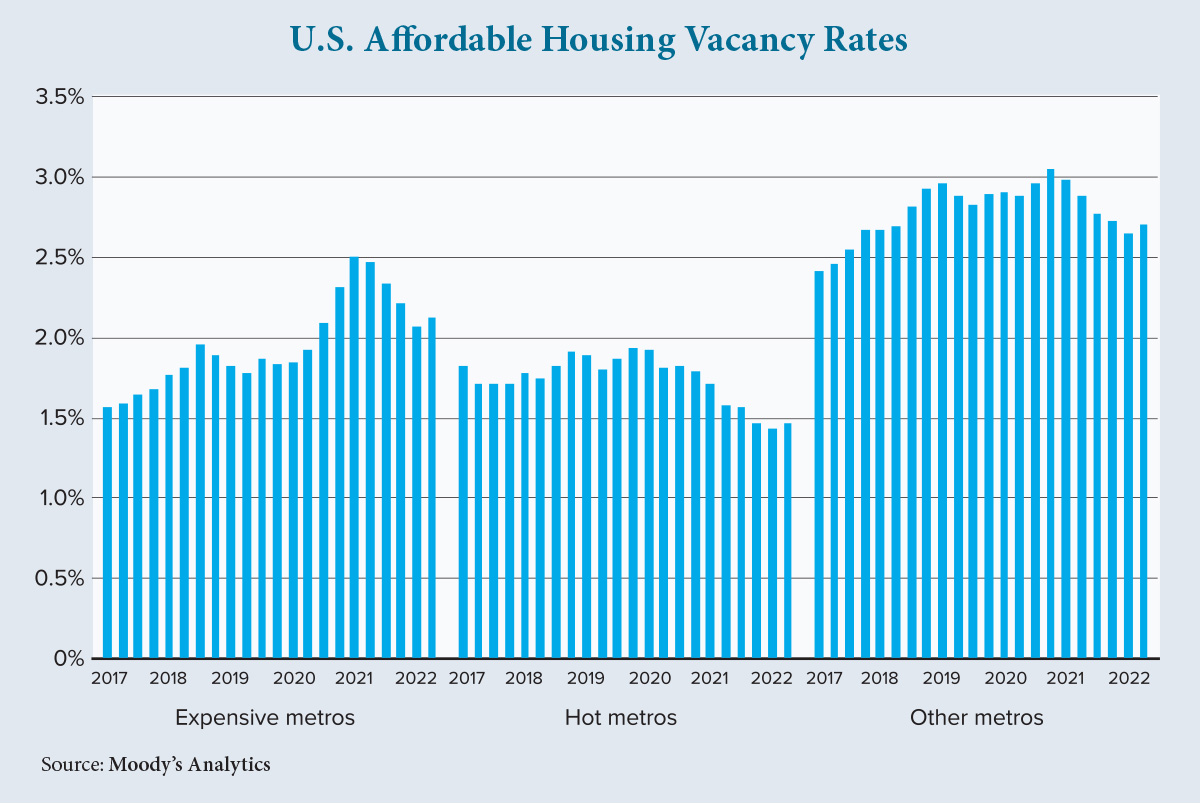

With an average wait time of at least 20 months, the high-demand affordable housing sector consistently runs at an extremely low vacancy rate (typically at about 2% nationally). The vacancy rate for this segment rose slightly to 2.6% in the first year of the pandemic. But with the strong multifamily market recovery — and a simultaneous lack of supply growth — pressuring affordability since the latter half of 2021, the affordable housing vacancy rate retreated and stabilized at 2.3%, a level not seen since 2018.

To understand how the affordable housing sector is doing at the metro level, we segmented the aforementioned 79 primary metro areas into three categories — expensive, hot and other — based on their pre-pandemic multifamily rent levels and multifamily rent growth since the start of the health crisis. Twenty metros were classified as “hot,” meaning they were among the top 25% of metros for steepest rent growth from February 2020 to March 2022. This group consists almost exclusively of Sun Belt cities such as Phoenix, Jacksonville, Las Vegas, Atlanta and Charlotte.

The so-called “expensive” metros were the 15 cities with the highest rents in February 2020, prior to the pandemic. This group includes gateway metros such as New York City, San Francisco and Boston, along with smaller coastal markets like Fairfield County, Connecticut, and Orange County, California.

As the accompanying chart shows, affordable housing in hot and expensive locations have notably lower vacancy rates compared to everywhere else. Construction projects also have been more active in the most expensive markets while notably lagging in the hot metros.

Affordable housing construction and leasing activities are especially active in expensive markets, with average asking rents hovering in the $1,300 per month range since early 2021, Moody’s data shows. These prices have consistently been at least 50% higher than the U.S. as a whole. And similar to the broader multifamily sector, asking rent growth for affordable units in hot metros outpaced that of expensive metros early in the pandemic and only began decelerating earlier this year.

In general, waitlist times positively correlate with a metro area’s rent burden, as measured by a rent-to-income (RTI) ratio. Across most metros, the higher the RTI, the longer the affordable housing waitlist. When holding the RTI constant, California metros tend to have longer wait times, while the opposite is true in Florida.

With the COVID-related national eviction moratorium and rent relief exemptions ending, demand for affordable housing (especially in hot metros) is already high and is expected to remain there. And with the passage of the Inflation Reduction Act, it is likely that we will see more investment in the affordable housing sector, especially in metros that pose increasing market-rate rent burdens to low-income households. ●

-

Lu Chen is a senior economist at Moody’s Analytics CRE. She has deep knowledge of urban economics and credit risk with special interests in senior housing and urban migration.

View all posts