For many years, the banking sector has flirted with commercial mortgage-backed securities (CMBS) data as a means of forecasting expected losses for commercial mortgage portfolios.

The global financial crisis of the late 2000s and subsequent regulations sped up the perceived need for (and the acceptance of) this type of predictive analysis. As a result, real estate finance practitioners have developed a more detailed and nuanced view of the CMBS dataset.

While loss-prediction modeling continues to dominate the commercial real estate market in terms of usage, many industry professionals have now recognized the value of frequently updated and accurate CMBS datasets. These can serve as indicators of current and coming stress in property and capital markets. Like many datasets, however, CMBS data does not come without its own array of problems.

Specifically, CMBS data can be difficult to organize and contextualize. Successful data-analytics teams must dedicate time on a daily basis for collecting, cleaning, organizing and interpreting this information. This effort tends to be quite useful, however, especially when paired with other complementary commercial real estate data points.

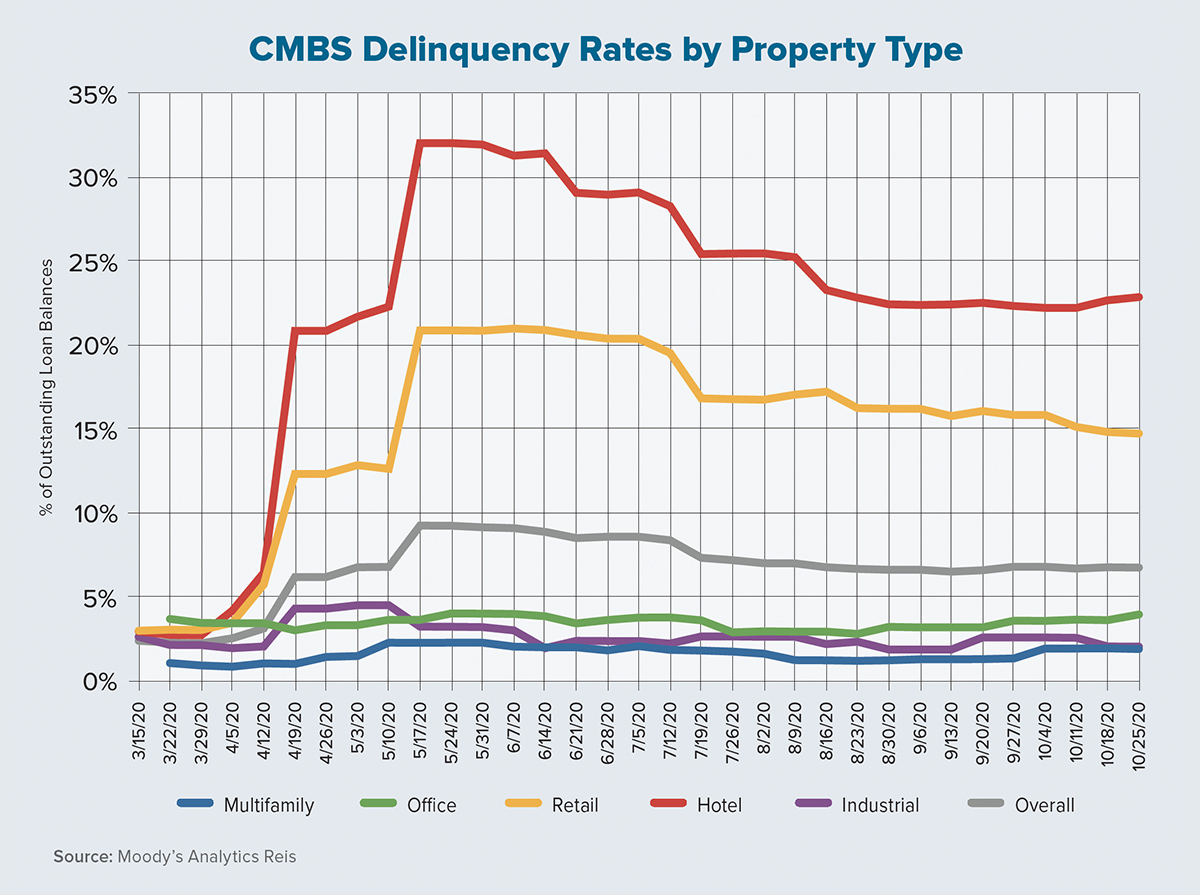

So, what is actually in the data? Mortgage delinquency rates tend to be most sought after for surface-level analysis. In the chart on this page, we demonstrate how delinquencies of 30 days or more have trended across all major asset classes throughout the COVID-19 pandemic. Note the intuitive spike for the hotel and retail sectors starting in April 2020 after the mandated shutdowns of a month earlier began to do some early damage.

The hotel and retail sectors saw delinquencies, as measured by their shares of outstanding loan balances, jump to 32% and 21%, respectively, in mid-May of last year before gradually declining over the next several months. Prior to the pandemic, these sectors had delinquency rates of less than 3% of outstanding debt.

Pair this with property-market data from the second quarter of last year and the picture becomes quite clear. For the lodging sector, revenue per available room dropped by as much as 90% year over year in some metropolitan areas during the initial heights of the pandemic. It is no surprise that hotel loans quickly became troubled.

The story and use of CMBS data does not end with delinquencies. Valuable indicators can be deduced by looking closely at watchlists and comments of special servicers, as well as loan modifications. Our data shows that modifications for retail loans lagged significantly behind those of the lodging sector, even when accounting for the fact that more hotel loans are delinquent.

This data likely expresses a greater willingness and ability of servicers to help hotel owners “kick the can,” so to speak. Lodging is going through a bad but temporary downturn while retail is going through a structural change. If the retail model is significantly different in a post-pandemic world, then kicking the can by modifying loan terms is not a viable strategy.

Although hotel properties in some markets will struggle for a long time to come, many surveys and anecdotes illustrate sizable pent-up demand for both leisure and business travel. Additionally, by looking at the details of comments and modification-category codes, hotel owners (especially branded-hotel operators) have significantly more cash reserves and auxiliary borrowing power than retail operations. This would tend to allow special servicers a greater ability to modify loans for this sector.

To summarize, CMBS data has far-reaching qualities beyond loan-loss modeling. The key to success for any mortgage professional is to dig deep into the more nuanced information. When combined with fundamental commercial real estate variables, trending CMBS data — such as watchlists, modifications, lease terms, tenant information and geography — can go a long way in helping us understand a complex real estate environment. ●

Authors

-

Thomas LaSalvia, Ph.D., is senior economist at Moody’s Analytics Reis. He has extensive experience in urban economics and credit risk.

View all posts -

Barbara Byrne Denham is former senior economist and associate director at Moody’s Analytics. She previously served as chief economist at Eastern Consolidated and is a Ph.D. candidate at New York University, where she has studied economics, monetary theory and game theory.

View all posts